Mobile Money: An Overview

The rapid adoption rates of mobile devices have been a catalyst for significant transformation in the financial services industry. In sub-Saharan Africa (SSA), and developing countries globally, more citizens own mobile devices than bank accounts. This enables innovative and creative methodologies for providing financial services to the unbanked. Mobile money has shown considerable promise in improving economies by moving cash. It is different from mobile banking, which is more prevalent and familiar to those living in developed countries. Mobile money is essentially a financial account, and associated services, offered by a mobile network operator (MNO), not a bank. In fact, it is separate from a bank from a user’s perspective. One may deposit and withdraw funds from a mobile money account by going to a MNO store. In addition, users may send money to another mobile money user by simply typing in the recipient’s mobile phone number on their phone. Also, many businesses accept mobile money as payment for their services.

M-Pesa, A Case Study

M-Pesa is an example of a mobile money service. It was introduced in April, 2007 in Kenya and became the world’s first broadly successful service. Within 2 years 21% of the Kenyan population and 40% of the adults were using this service[1]. Also during this time frame Safaricom, the country’s largest MNO, was processing $320M per month in person-to-person transfers, equal to 10% of Kenya’s GDP. These transfers increased to 43% of Kenya’s GDP within 6 years[2]. In addition, monthly deposit and withdrawal transactions at m-Pesa stores totaled $650M. Within 2 years Safaricom’s monthly m-Pesa revenue was $7M per month, 8% of the company’s total revenue. Within 3.5 years, over 70% of Kenyan households, and over 50% of the poor, unbanked and rural populations used the service[3].

m-Pesa has economically transformed Kenya, extended financial inclusion for nearly 20M Kenyans, and facilitated the creation of small businesses. The percentage of people living on less than $1.25 a day who use m-Pesa rose from less than 20% in 2008 to 72% by 20112. Businesses are using m-Pesa for payments (e.g., dividends, collecting payments from customers, etc.). For example, 20% of the 1M electric utility company customers pay with M-Pesa3. This enables companies to cut costs and become more efficient. In addition, citizens use m-Pesa to pay bills, purchase mobile phone credits, fund-raise for a variety of purposes (e.g., medical, education, disaster relief) and donate to charities. It also reduces risk. For example, taxi drivers can operate more safely; they do not have to carry large amounts of cash. Additional economic benefits of m-Pesa include increased savings and investment, risk spreading, and insurance[4]. In rural Kenyan households that adopted M-Pesa, incomes increased by 5-30%.

A Developing Market

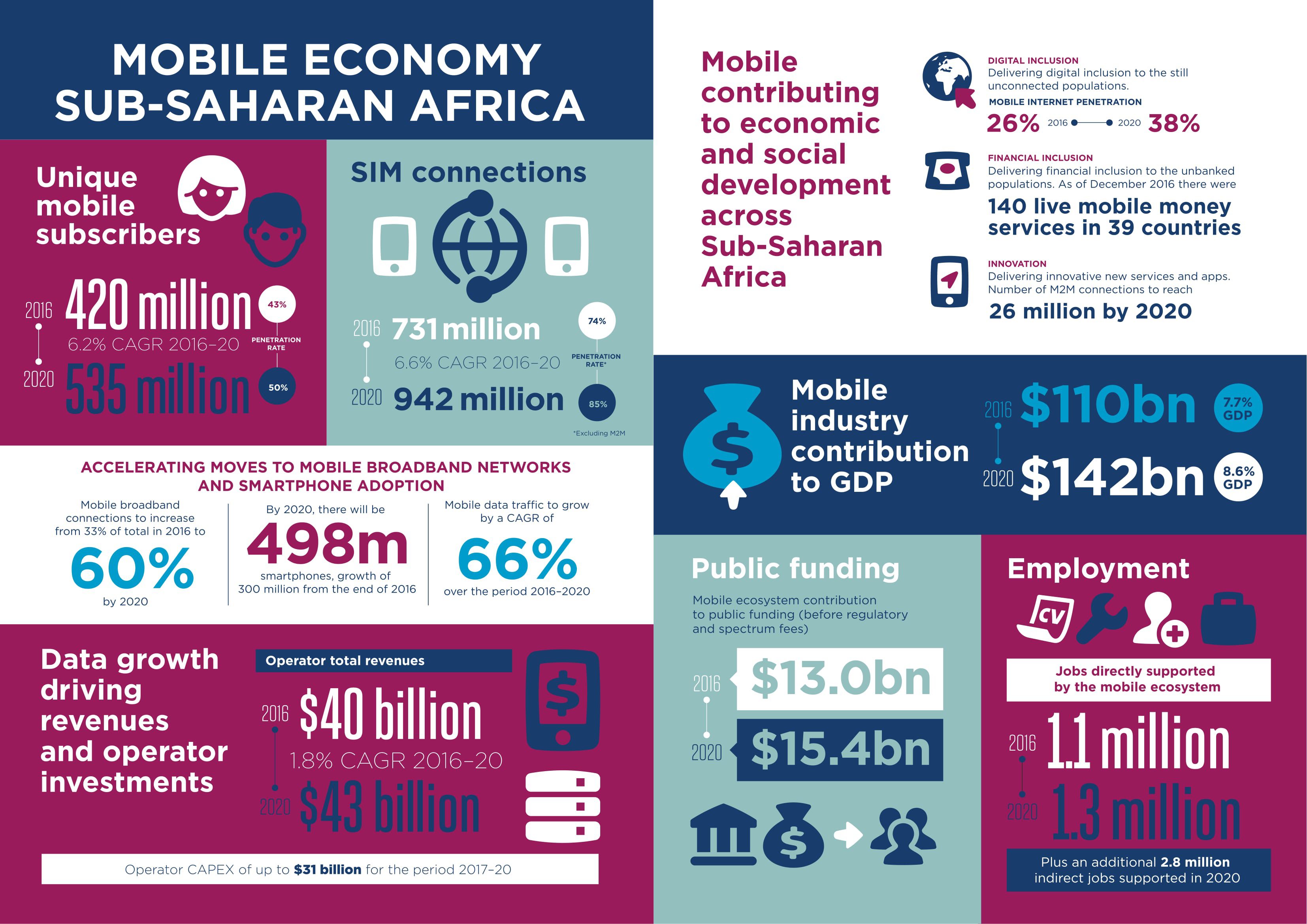

The SSA telecommunications market is the fastest growing globally. The number of unique mobile subscribers in SSA is expected to grow at a compound annual growth rate (CAGR) of 6.2%, 2016-2020 (see infographic from the GSM Association). In addition, the mobile penetration rates will grow from 43% (420M people) in 2016 to 50% (535M people) in 2020. Further, the mobile industry’s contribution to GDP will increase from 7.7% ($110 billion) in 2016 to 8.6% ($142 billion) by 2020[5]. There exists a migration to higher speed networks and smart phones in SSA. Mobile broadband connections will increase from just over 33% of the total in 2016 to 60% by the end of the decade. This is driven by falling device prices. There will be an increase of more than 498 million new smart phone connections by 2020, resulting in an over half-billion device install base. As a result, mobile money will be the foundation for more innovative and creative mobile-app-based services in the future.

[1] Mus, I. and A. Ng’weno, “Three Keys to M-PESA’s Success: Branding, Channel Management and Pricing”, Bill and Melinda Gates Foundation, March, 2012.

[2] Runde, D., “M-Pesa and the Rise of the Global Money Market”, forbes.com, August 12, 2015.

[3] Alexandre, C., “10 Things You Thought You Knew about M-PESA”, CGAP.com, November 22, 2010.

[4] Jack, W. and T. Suri, “The Economics of M-PESA”, MIT, August, 2010.

[5] M The Mobile Economy: Sub-Saharan Africa”, GSM Association, 2017.