geeRemit: A Global Remittance Blockchain Mobile App

SEE geeREMIT VIDEO!

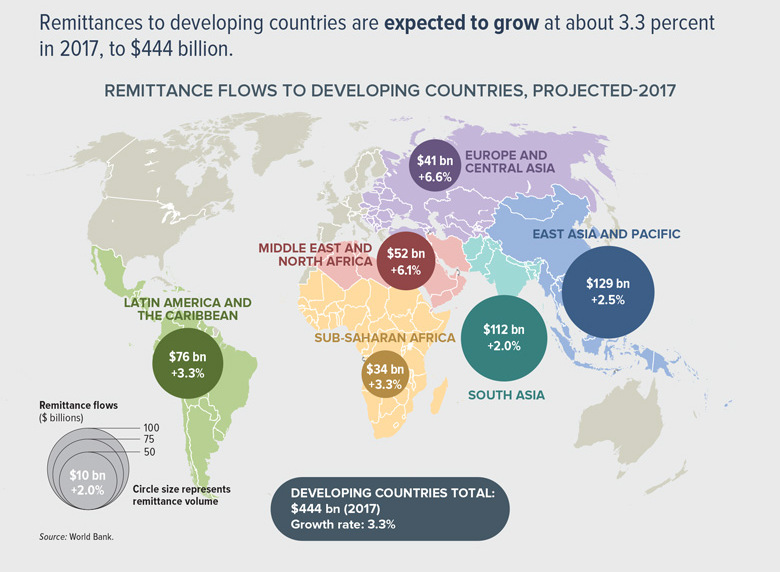

Many people in developing countries have difficulty making ends meet. They rely on family members and friends in the west to send money home. Remittance solutions are a vital component of the financial infrastructure and an important source of income for millions of families in the world’s 140 developing countries. The World Bank has projected global remittances to reach $444B this year (see Figure), a 3.3% increase versus 2016.

Furthermore, in sub-Saharan Africa (SSA) and other developing countries, more citizens own mobile devices than bank accounts. The number of unique subscribers is expected to reach 520M by 2020. Mobile is driving innovation and digital and financial inclusion in SSA. For example, mPesa is a popular mobile money solution that is the major source of payments in Kenya. Leveraging such devices in this space is a $16B opportunity. Bringing mobile payments and global remittance together in a cost-effective and secure manner creates a multi-billion dollar opportunity in SSA and hundreds of developing countries worldwide.

Global remittance funds are used by recipients for health care, education, proper nutrition and other critical expenses. However, the typical international money transfer requires significant communication between the sender and receiver. One or both need to calculate exchange rates, synchronize amounts, collect personal details and then ensure the cash has been sent and received. In addition, the cost for sending money home can be expensive. For example, in 2016 the average global cost of sending $200 was 7.45% (or $14.90). SSA had the highest cost at 9.8% or ($19.60). Therefore, global remittance comes with high transfer and other fees, concerns about security and issues for the sender and receiver just getting to the money transfer facility.

The traditional remittance solution to developing countries is to leverage the services of Western Union, Moneygram or Ria. However, their services offer the highest fees. Recent partnerships, e.g., Viber and Western Union or WeChat and Western Union, enable mobile apps to play a larger role in this space. While this addresses one side of the logistical issue of reaching an establishment to initiate the money transfer, it does not address this issue for the recipient. Furthermore, money transfer fees are still high.

There are existing blockchain-based alternatives to traditional money transfer methods; e.g., Sentbe, SCI and Paybill. While these options provide some reduction in fees and increased security, they do not address the logistical issues around getting the funds to the recipient. Furthermore, the recipient does not have immediate access to the funds.

geeRemit is a mobile global remittance app that offers reduced cost, world-class security based on a game-changing blockchain technology, and mobile-to-mobile transactions. The initial geeRemit market focus is SSA; a $34B opportunity in a $444B global remittance market (see Figure). This is because SSA, particularly East Africa, is a place where mobile money is an integral part of every-day society. Also, this app offers the consumer an opportunity for the most significant reduction in transaction fees.

In summary, geeRemit offers a low-cost, logistics-free global remittance service. It is based upon blockchain, an exciting, new, secure game-changing technology. A mobile phone is used to send funds home, and the recipient receives it as mobile money directly on their phones. It resolves all location-based logistical issues, as the transactions are done via mobile phones. The money is available in a short time frame, offering the fastest, most economical and convenient service on the market. This is an attractive value proposition for customers. For more information see this geeRemit video.